Ch. 6 Equity

6.2 Accounting for Capital

Learning Objective

Once you complete this section, you will be able to:

- Understand and record equity-related transactions from the corporation’s perspective.

- Recognize the financial implications of dividends and stock ownership from the shareholder’s perspective.

CONTRIBUTED CAPITAL

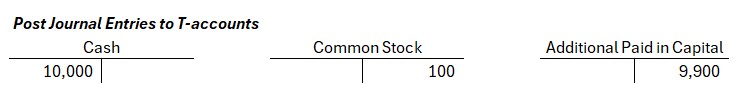

Usually two accounts are used to record contributed capital or the issuance of stock to shareholders. The two accounts include Common Stock and Additional Paid-in Capital (APIC). Common Stock represents the number of shares issued to shareholders multiplied by the par value per share. APIC represents the amount invested by shareholders above the par value per share.

Example: Journal Entry for Share Issuance

The following example captures the journal entry required when a corporation issues shareholders shares in the corporation:

ABC Corporation issues 1,000 shares in its company to respective shareholders for $10,000. The stock has a par value of $0.10 per share.

| Balance Sheet | Income Statement | Stmt of Cash Flows | |||||||||||

| Cash | = | Common Stock * | + | Add. Paid-in Capital | + | Retained Earnings | Revenue | – | Expense | = | Net Income | Cash | OA,IA,FA |

| 10,000 | = | 100 | + | 9,900 | 10,000 | FA | |||||||

| Journal Entry | ||

| Cash | 10,000 | |

| Common Stock | 100 | |

| Additional Paid in Capital | 9,900 |

* Common stock is calculated as: 1,000 shares at par value of $0.10 per share.

EARNED CAPITAL

Separate from shareholders’ contributed capital recorded in the Common Stock and APIC accounts are the profits a corporation has accumulated over time, or what is referred to as earned capital. Accountants capture this balance in the Retained Earnings account. Retained Earnings accumulates a corporation’s total net earnings since the company’s inception and then subtracts the total amount distributed to shareholders.

The Retained Earnings (Earned Surplus) Calculation is as follows:

Beginning Retained Earnings

+Net income (if Net loss, subtract balance)

-Dividends or distributions paid to shareholders

=Ending Retained Earnings

Retained Earnings illustrates a basic financial choice available to corporations: they can either (1) distribute profits to shareholders subject to legal limitations discussed earlier in Chapter 6.1, or (2) reinvest profits into the business. The portion of earnings not distributed becomes part of Retained Earnings which may then be reinvested accordingly. A company may choose to reinvest profits into the business to fund growth, improve infrastructure, or expand capacity, with the objective of generating future income.

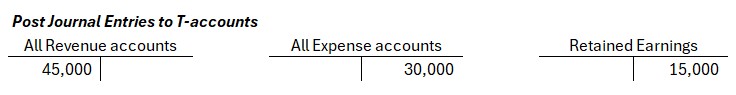

CLOSING ENTRIES

Review from LO 2.5 Closing Entries

At the end of each accounting cycle, Net Income is closed into Retained Earnings.

Example: Closing Net Income into Retained Earnings

If ABC corporation reports $15,000 as Net Income (Revenue of $45,000 and Expenses of $30,000) during its accounting period, the closing entry is recorded as follows:

Note: If the horizontal method is used, revenues and expenses are have already been closed to Retained Earnings.

| Balance Sheet | Income Statement | Stmt of Cash Flows | |||||||||||

| Cash | = | Common Stock | + | Add. Paid-in Capital | + | Retained Earnings | Revenue | – | Expense | = | Net Income | Cash | OA,IA,FA |

| 15,000 | = | 15,000 | 45,000 | – | 30,000 | = | 15,000 | 15,000 | OA | ||||

| Journal Entry | ||

| All Revenue accounts | 45,000 | |

| All Expenses accounts | 30,000 | |

| Retained Earnings | 15,000 |

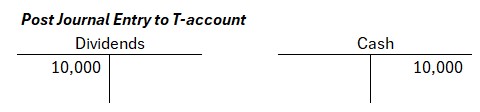

Based on the Retained Earnings calculation, dividends or distributions paid to shareholders will also impact the balance. When dividends or distributions are paid to shareholders, the Dividends account is increased by a debit whereas Cash is credited for the balance paid.

Example: Recognizing Dividends Paid/Closing Dividends into Retained Earnings

ABC Corporation paid $10,000 in dividends to its shareholders during the accounting period. The initial entry to record these payments was:

| Balance Sheet | Income Statement | Stmt of Cash Flows | |||||||||||||

| Cash | + | Noncash Assets | = | Liability | + | Common Stock | + | Retained Earnings | Revenue | – | Expense | = | Net Income | Cash | OA,IA,FA |

| -10,000 | = | -10,000 | |||||||||||||

| Journal Entry | ||

| Dividends | 10,000 | |

| Cash | 10,000 |

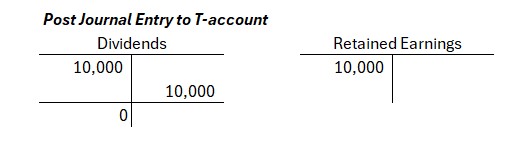

Note: If you do not use the horizontal model, you will need an additional journal entry to close dividends to Retained Earnings.

To close ABC Corporation’s Dividends account at the end of the accounting period, the following closing entry would be recorded:

| Journal Entry | ||

| Retained Earnings | 10,000 | |

| Dividends | 10,000 |

CASH DIVIDENDS FROM THE SHAREHOLDER’S PERSPECTIVE

From the standpoint of a shareholder, income derived from owning common stock generally takes one of two forms.

First, shareholders may receive cash dividends, which constitute a taxable event under federal income tax law. When a corporation distributes a cash dividend, the shareholder is treated as having received ordinary income in the amount of the dividend at the time it is paid. This income is subject to taxation in the year of receipt regardless of whether the shareholder reinvests the funds.

Second, shareholders may recognize income upon selling their shares for a profit. If the sale price of the stock exceeds the shareholder’s basis, usually the original purchase price, the shareholder realizes a capital gain which may be subject to either short-term or long-term capital gains tax depending on the holding period.

It’s important to note that the basis is not always static. Although it begins as the amount the shareholder paid to acquire the stock, it can be adjusted over time due to various tax-related events such as stock splits, return-of-capital distributions, or certain corporate reorganizations which may increase or decrease the adjusted basis used to compute gain or loss upon sale.

Understanding these distinctions is critical not only for tax planning but also for evaluating shareholder rights and corporate governance decisions related to distributions and stock transactions.

SUMMARY

A corporation’s equity includes both contributed capital (i.e., what shareholders invest) and earned capital (i.e., profits the company keeps over time). These amounts are tracked through accounts like Common Stock, Additional Paid-in Capital, and Retained Earnings. Accurate records of stock issuances, profits, and dividends help the company make sounds financial decisions. For shareholders, it’s important to understand how dividends and stock sales are taxed and how their investment value may change over time. Overall, these basics are key to understanding how corporations manage money to benefit shareholders.

Homework 6.2: Equity, Dividends & Retained Earnings

You work as a financial consultant for Dunder Mifflin Legal Services, Inc., a boutique law corporation formed by former attorneys from law firms like Hamlin, Hamlin & McGill, Pearson Specter Litt, and Cahill & Associates. At formation, the corporation issued shares to its founding attorneys and new investor-shareholders. The following equity transactions occurred during the year ended December 31, 2024:

Transaction 1 – Issuance of Shares: On January 1, 2024, the corporation issues 5,000 shares at $5 per share. Each share has a par value of $0.50.

Transaction 2 – Net Income for the Year: For the year, Net Income totaled $120,000 from high-fee trademark litigation and celebrity endorsement contract negotiations.

Transaction 3 – Dividend Declaration & Payment: On December 15, 2024, the board declares and pays cash dividends of $25,000 to shareholders.

Required 6.2 a- From the Corporation’s Perspective

- Record the journal entry for the share issuance.

- Compute and record the closing entry to transfer net income into Retained Earnings.

- Record the dividend payment and the closing entry to Retained Earnings.

- Prepare the ending balance of Retained Earnings assuming beginning retained earnings were $30,000.

Required 6.2 b– From the Shareholder’s Perspective

Assume Kim Wexler, an early investor, purchased 500 shares at issuance for $2,500 total.

- How much dividend income does she recognize for tax purposes from this distribution?

- If she later sells her shares for $6,500, how much capital gain would she realize? Assume no basis adjustments occurred during the year.