Ch. 5 Financial Statement Analysis

5.1 Income Statement and Financial Statement Sources

Learning Objectives

Once you complete this section, you will be able to:

- Analyze how income statement presentation affects interpretation of earnings.

- Apply income statement information in financial analysis.

Net income is often referred to as the “bottom line” measure of a company’s performance. It reflects the outcome of accrual accounting, including how revenues and expenses are recognized and matched, based on policies chosen by management. Under Generally Accepted Accounting Principles (GAAP), accounting earnings have traditionally been emphasized because they tend to be good predictors of a company’s future cash flows. Valuation theory reinforces this idea, showing that the economic worth of a business depends largely on the present value of its expected future cash flows. For this reason, professional investors rely heavily on accounting numbers when evaluating a firm’s economic value.

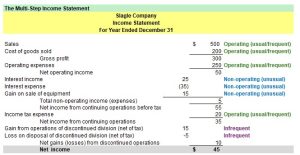

Under GAAP, companies must report income in a way that helps assess how much of it is persistent and therefore meaningful in evaluating long-term value. A single-step income statement calculates net income by subtracting total expenses from total revenues in one step. In contrast, a multiple-step income statement presents additional intermediate measures including gross profit, operating income, or income from continuing operations before taxes before arriving at net income.

The order of presentation in the income statement matters. Accounts that are both common and central to ongoing operations are highlighted first. By comparison, unusual items, or those unrelated to normal operations or only incidentally connected are reported further down, as they are less likely to recur in the future.

Example 13-1

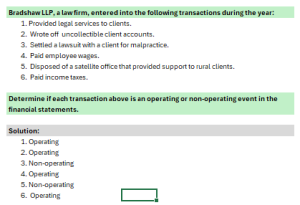

Usual and recurring items generally include sales revenue, cost of goods sold, and operating expenses. These accounts appear in most companies’ income statements because they are central to normal operations. In contrast, some items such as interest expense, interest income, or gains on the sale of equipment occur frequently but are not considered part of a company’s core business. These are classified as non-operating items.

Other items, like restructuring charges or write-downs of assets, are infrequent items. They don’t happen often, but when they do, they must still be reported. What sets them apart is that they are not part of regular business operations and are not expected to recur regularly.

Each line in the income statement is considered part of ongoing operations and is shown before income tax expense, unless GAAP requires otherwise. GAAP rules state that certain unusual or one-time events must be reported after tax. For example, if a company discontinues or sells a major part of its business, the related income or loss is presented on a net-of-tax basis. This approach ensures that income tax expense linked specifically to discontinued operations is shown separately from taxes on continuing operations. Separating discontinued activities from ongoing results helps analysts and investors focus on the company’s operational earnings.

Most experts agree that this separation makes the income statement more useful. However, it can also complicate things, because items affecting income tax expense may appear in more than one section. When this happens, accountants must allocate the company’s total income tax expense across the sections in which the related items appear.

Discontinued Operations

When a company sells, shuts down, or otherwise disposes of part of its operations, the results are reported in a discontinued operations section of the income statement. This section covers two main items:

- The income or loss from that segment’s operations up to the date of discontinuance.

- Any gain or loss from the actual disposal of the segment.

This information is shown right after income from continuing operations.

In Example 13-1, if Slagle Company sells its pet food division, the income statement will display the results separately. From January 1 through June 30, the division might have earned $15 (after taxes), and the sale of its assets and liabilities could create an additional $5 loss. The discontinued operations section would show these amounts separately from the company’s ongoing results. This ensures that “net income from continuing operations” clearly reflects only the portions of the business that remain active.

Example: Transaction Types

Sources of Information

With the exception of privately held companies, most businesses release financial statements each year, and larger companies typically issue quarterly reports as well. These financial statements are usually audited by a certified public accountant, whose opinion provides assurance on the reliability of the financial data.

For publicly traded companies, the U.S. Securities and Exchange Commission (SEC) requires the filing of specific reports:

- Form 10-K – the annual report, which includes comprehensive details about financial performance.

- Form 10-Q – the quarterly report, which updates investors with more frequent information.

These reports are available to the public and generally provide more detail than a company’s self-published annual or quarterly reports.

Investment professionals often rely on these filings to evaluate company performance, but they also compare firms across the same industry. To do this, they use industry data, including:

- Industry averages and norms

- Median financial ratios

- Comparative data from sources such as Dun & Bradstreet, Moody’s, and Standard & Poor’s

In addition, many brokerage firms provide their clients with customized financial ratios and industry benchmarks, drawn from proprietary databases. This helps investors place a company’s performance in context and make more informed decisions.

Homework 5.1

Slagle Pet Products, Inc. is your client. They are considering selling one of their divisions and want legal advice on how this sale may affect the company’s financial statements, investor perception, and their contracts with lenders.

Here are the 2024 results before considering the sale:

-

Sales revenue: $1,200,000

-

Cost of goods sold: $700,000

-

Operating expenses: $300,000

-

Interest expense: $50,000

-

Lawsuit settlement (one-time): $100,000

-

Income from the Pet Food Division (Jan–June 2024): $40,000 (after tax)

-

Loss on disposal of the Pet Food Division: $10,000 (after tax)

Step One: Identify Transaction Types

For each line item above, classify whether it is:

-

Operating

-

Non-operating

Step Two: Prepare a Multiple-Step Income Statement

Draft a simplified multiple-step income statement for Slagle Pet Products as of December 31, 2024, clearly separating:

-

Gross profit

-

Operating income

-

Income from continuing operations

-

Discontinued operations

-

Net income