Ch. 7 Time Value of Money and Valuations

7.1 Relevance to Legal Practice

Learning Objectives

After reviewing this section, you will:

- Understand the importance of Time Value of Money (TVM) principle in legal contexts, including settlements, structured payments and other arrangements.

Lawyers often hear the phrase “time is money” especially when filling out timesheets for billable hours. However, this saying also has a deeper financial meaning: the concept of the Time Value of Money (TVM). This principle holds that a dollar today is more valuable than a dollar tomorrow. This chapter explores how TVM influences both litigation and transactional legal work.

To illustrate, think of borrowing money like renting a car. In both cases, the user pays for the right to use an asset. For money, that “rental cost” is called interest. For borrowers, TVM represents the cost of using money over time. For lenders or investors, it reflects the return earned over that same period.

TVM principles are widely applicable in legal contexts. Attorneys who understand TVM are better equipped to settle disputes, advise clients on financial matters, and develop strategic plans.

Example: Application of TVM Principle

Consider a scenario: your client is offered a $5 million settlement now or can go to trial and potentially win $6 million in three years. At a 3% annual interest rate, compounded annually, the Present Value (PV) of $6 million received three years from now is:

PV = $6,000,000/ (1+0.03)^3 = $5,141,938

Because the present value of the trial award is slightly more than $5 million, your client may prefer to go to trial. However, how would the client’s perspective change if the interest rate was 5%:

PV = $6,000,000/ (1+0.05)^3 = $4,834,114

In this case, the settlement becomes more attractive. These calculations help lawyers and their clients make informed decisions.

Johnson & Johnson Settlement

Creative application of TVM has shaped major legal outcomes. A modern example is the $26 billion opioid settlement finalized in 2022 involving Johnson & Johnson (J & J) and three major drug distributors. J & J agreed to pay up to $5 billion over a maximum of nine years to resolve opioid-related claims in its share of the $26 billion national settlement. Assuming a plausible structured schedule, J&J’s payment schedule would be:

| Year | Approximate Payment |

| 1 | $1.23 billion |

| 2 | $1.23 billion |

| 3 | $1.24 billion |

| 4–9 | $250 million per year |

Assuming a 6% discount rate, the present value (PV) of the payment stream:

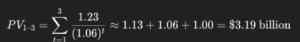

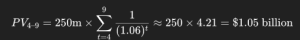

- PV of Years 1–3 total ($3.7 billion):

- PV of years 4–9 ($250 million annually):

- Total PV ≈ 3.19 billion +1.05 billion=$4.24 billion

Under these assumptions, the present value of J&J’s $5 billion obligations would approximate $4.24 billion, not accounting for inflation or risk adjustments.

Summary

Lawyers must help clients determine appropriate interest rates, investment return assumptions, or discount rates to evaluate future versus present values. These tasks demand an understanding of financial markets, regulatory benchmarks, and sound professional judgment.

In estate planning, TVM is critical for valuing estates, structuring charitable trusts, and guiding beneficiaries on life insurance options. Tax attorneys use TVM to defer income and accelerate deductions. TVM also applies when seeking prejudgment interest. Courts must choose an appropriate rate, which might be set by statute or require analysis of market benchmarks.

Understanding the time value of money enables lawyers to provide better advice, draft stronger agreements, and secure more favorable outcomes for clients across many areas of practice.