Calculate the future value of single sums and long-term investments using Excel tools, and explain the implications of compounding for legal scenarios involving trusts, settlements, and financial planning.

Ch. 7 Time Value of Money and Valuations

7.3 Future Value

Learning Objective

After completing this section, you will be able to:

Future value refers to the amount a sum of money will grow to after a certain number of periods at a given compound interest rate. It applies both to single investments and to streams of equal, recurring contributions (i.e., annuities). This section introduces future value calculations for both types, starting with single amounts.

Future Value of Single Amounts

Attorneys may need to calculate the future value of a single amount in various legal contexts where a one-time payment or investment grows over time. Circumstances where this may be the case include:

- Lump-Sum Settlements or Awards: When advising a client whether to accept a lump-sum settlement or go to trial for a potentially larger payout later, attorneys calculate the future value of the lump sum to compare outcomes over time.

- Trust and Estate Planning: Attorneys calculate how a one-time contribution to a trust or investment account will grow by a future date, helping clients plan for future distributions to heirs, charities, or beneficiaries.

- Structured Investment Agreements: in business or financial contracts, an attorney may evaluate the future worth of an upfront investment (e.g., a capital injection or seed funding) based on expected interest or return rates.

- Education or Special Needs Trusts: Attorneys often need to determine whether a one-time deposit into a fund will grow sufficiently to meet anticipated future expenses, such as tuition or lifelong care costs.

- Damage Calculations in Litigation: When a defendant’s wrongful act delays or prevents a one-time investment, attorneys may calculate what that investment would have been worth at a later date to quantify damages.

- Prejudgment Interest: In civil litigation, attorneys may compute the future value of a one-time financial harm to support a claim for prejudgment interest, especially when interest is not fixed by statute.

- Loan or Financing Agreements: In drafting or analyzing financial contracts, attorneys may project the future value of a single loan disbursement or bond to evaluate payoff amounts or redemption terms.

Leveraging the single-amount future value calculation to project how a one-time sum will grow over time helps support an attorney’s advisory role with clients.

Future Value of Single Amount Examples

Below are two examples of calculations used to support the future value of single amounts:

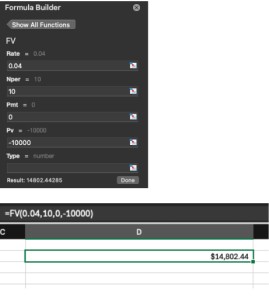

Example 1: Single Amount over 10 Years

Suppose Olivia invests $10,000 in a fixed-income account that earns 4% interest, compounded annually. How much will her investment be worth after 10 years?

Using the future value formula:

FV = PV*(1+r)^n = $10,000*(1+0.04)^10 = 10,000*1.480244 = $14,802.44

Rather than relying solely on tables, professionals now use tools like Microsoft Excel to compute future values efficiently. In Excel, you can use the FV function:

=FV(rate, nper, pmt, [pv], [type])

For the above example:

=FV(0.04, 10, 0, -10000)

This function returns $14,802.44, matching our manual calculation. So, Olivia’s investment grows to approximately $14,802.44 after a decade.

Let’s examine a more extensive example that spans generations.

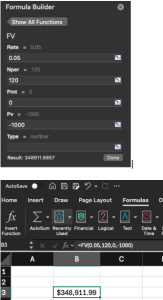

Example 2: Single Amount over 120 Years

Imagine that in 1903, an early investor placed $1,000 into a trust fund earning 5% annual compound interest. What would be the value of that investment in 2023, 120 years later?

Using the future value formula:

FV = PV*(1+r)^n = $1,000*(1+0.05)^120 = 1,000*348.91199 = $348,911.99

Rather than relying solely on tables, professionals now use tools like Microsoft Excel to compute future values efficiently. In Excel, you can use the FV function:

=FV(rate, nper, pmt, [pv], [type])

For the above example:

=FV(0.05, 120, 0, -1000)

This function returns $348,911.99, matching our manual calculation. This calculation highlights the incredible power of compounding over long periods. If that $1,000 had been left untouched in a stable investment, its value would have grown nearly 348-fold.

Future Value of Multiple Amounts

Attorneys may need to calculate the future value of multiple payment streams in legal contexts where recurring contributions or payments accumulate over time. Situations where this may apply include:

- Structured Settlements: In personal injury or wrongful death cases, attorneys often negotiate structured settlements that pay the plaintiff a series of future installments. Calculating the future value helps determine the total benefit over time and compare lump-sum versus periodic payment options.

- Retirement or Pension Planning (Estate and Tax Law): Estate planning attorneys may evaluate retirement accounts or pension plans funded with regular contributions to estimate their value at retirement. This helps clients plan asset transfers or charitable trusts.

- Trust Administration: Lawyers managing or advising on long-term trusts (e.g., education or special needs trusts) must forecast the future value of recurring contributions to ensure the fund meets future obligations.

- Divorce and Family Law: When dividing marital assets, attorneys may calculate the future value of ongoing financial commitments such as alimony, child support, or retirement contributions to determine equitable distributions.

- Business Buy-Sell Agreements: In corporate or partnership law, attorneys may use future value calculations to assess payment streams in deferred buyouts, installment purchases, or earn-out clauses tied to business performance

- Damages in Breach of Contract: When a contract breach affects a stream of expected payments (e.g., licensing royalties or lease income), attorneys may calculate the future value of those lost payments to quantify damages.

- Prepaid Legal Services or Retainers: In law firm management, attorneys may need to estimate the future value of recurring retainer payments for long-term clients or legal service contracts.

As with the single-amount future value calculation, using the future value of multiple amount calculation to project the future value of multiple payment streams allows lawyers to help clientele with their decision making.

Future Value of Multiple Amount Example

Below are examples of calculations used to support the future value of multiple amounts:

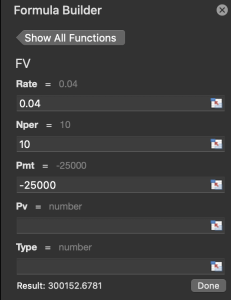

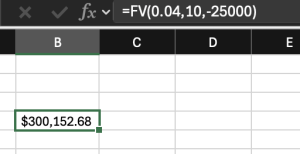

Example 1: Ten Year Annuity

An attorney is negotiating a structured settlement for a personal injury client. The defendant agrees to pay $25,000 annually for 10 years, with the funds placed in an account earning 4% interest compounded annually. The attorney needs to calculate the future value of these payments to help the client understand the total worth of the settlement at the end of the 10-year period.

The formula to calculate the future value of the payment stream is:

FV = PMT× ((1+r)n−1)/r)

Where:

-

FV = future value

-

PMT = payment per period = $25,000

-

r = interest rate per period = 0.04

-

n = number of periods = 10

FV=25,000×((1+0.04)10−1)/ 0.04) = 25,000 × ((1.48024−1) / 0.04) = 25,000×12.0061 = $300,153

Rather than relying solely on tables, professionals now use tools like Microsoft Excel to compute future values efficiently. In Excel, you can use the FV function:

=FV(rate, nper, pmt, [pv], [type])

For the above example:

=FV(0.04, 10, -25000, 0)

By the end of 10 years, the structured settlement will have grown to approximately $300,153 due to annual compounding. This allows the attorney to clearly explain the long-term financial value of the settlement and compare it with potential lump-sum offers.

Example 2: Future Value of Recurring Contributions in Special Need Trust

An attorney is advising a family on funding a special needs trust for their child. The family plans to contribute $10,000 annually to the trust for 15 years, and the trust is expected to earn a 5% annual return, compounded annually. The attorney must calculate the future value of these recurring contributions to ensure that the trust will have sufficient funds to cover the child’s long-term care expenses.

The formula to calculate the future value of the payment stream is:

FV = PMT× ((1+r)n−1)/r)

Where:

-

FV = future value

-

PMT = payment per period = $10,000

-

r = interest rate per period = 0.05

-

n = number of periods = 15 years

FV = $10,000 × ((1+0.05)15−1)/0.05) =$10,000×((2.07893−1)/0.05) = $10,000×21.5786 = $215,786

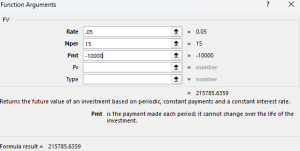

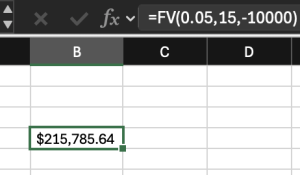

Rather than relying solely on tables, professionals now use tools like Microsoft Excel to compute future values efficiently. In Excel, you can use the FV function:

=FV(rate, nper, pmt, [pv], [type])

For the above example:

=FV(0.05, 15, -10,000, 0)

After 15 years of $10,000 annual contributions, the special needs trust will grow to approximately $215,786, assuming a 5% annual return. This calculation helps the attorney confirm that the funding strategy aligns with the projected future care costs and informs recommendations for trust design and investment strategy.

Summary

Homework 7.3.1

Future Value of a Single Amount (Trust Planning Scenario)

Scenario:

In a wrongful death case, the court awards the plaintiff’s family a structured settlement of $40,000 per year for 15 years, to be invested in an account earning 4% interest, compounded annually. The plaintiff’s attorney wants to demonstrate how much the settlement will be worth at the end of the 15-year period.

Requirements:

-

Compute the future value of this 15-year payment stream.

-

Estimate the total settlement growth due to compounding.

Formula:

Where:

Homework 7.3.2

Future Value of a Single Amount (Trust Planning Scenario)

Scenario:

Attorney Lawson is advising a client who wishes to set aside a one-time lump sum of $75,000 today to fund a charitable education trust for underprivileged students. The trust will remain invested for 12 years at an expected annual return of 5.5%, compounded annually.

Requirements:

-

Calculate the future value (FV) of the $75,000 after 12 years.

-

Determine how much interest income the trust will have earned.

-

Explain how compound growth supports fiduciary duties when attorneys advise on long-term trust investments.

Formula:

Where: