Ch. 7 Time Value of Money and Valuations

7.5 Comprehensive Illustration

Learning Objective

By the end of this section, students will be able to:

- apply multiple time value of money (TVM) concepts, including present value and annuity calculations, to a real-world legal and financial scenario.

To this point, we’ve examined several distinct time value of money (TVM) computations—future and present values of both single amounts and annuities, as well as perpetuities. In real-world legal and financial contexts, these concepts often need to be combined. This section presents an integrated example that requires applying multiple TVM principles, particularly in the areas of settlement analysis.

Example: Choosing Between a Lump Sum, a Deferred Payment, and an Annuity

Suppose a client in a workplace discrimination settlement is offered three options:

- An immediate cash payout of $275,000

- A lump sum of $525,000 in 10 years

- An annuity paying $65,000 annually for 5 years, beginning in one year

Assume a 5% annual discount rate and no taxes. Which option has the highest present value?

Option 1: Present value = $275,000*

*No calculation is required.

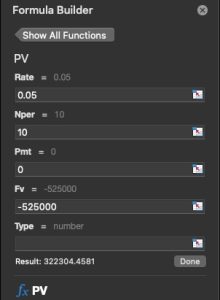

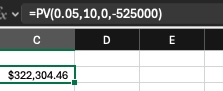

Option 2: Present value of a future payment of $525,000 in 10 years

PV = FV/ (1+r)^n

Where as:

- PV = Present Value

- FV = Future Value

- r = annual discount rate

- n = number of periods

PV = FV/ (1+r)^n= $525,000/(1+0.05)^10 = $322,304

In Excel, the approach would be:

=PV(0.05,10,0,-525000)

The present value of Option 2 is approximately $322,304.

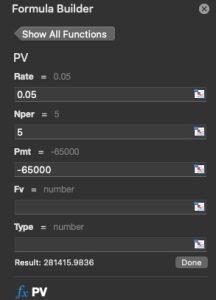

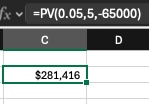

Option 3: Present value of a five-year annuity of $65,00 each year.

PV = PMT * ((1-(1+r)^n)/r)

Where as:

- PV = Present Value

- PMT = Annuity payment

- r = annual discount rate

- n = number of periods

PV = PMT * ((1-(1+r)^-n)/r) = $65,000*(1-(1+0.05)^-5)/0.05 =

$65,000 * 4.3294767=$281,416

In Excel, the calculation would be:

=PV(0.05,5,-65000)

The present value of Option 3 is approximately $281,418.

CONCLUSION

Option 2, the deferred lump sum, yields the highest present value. Legal counsel should advise clients to weigh present value, not just total payout. Additionally, attorneys on contingency should clarify whether their fee is based on gross award or its present value.

Integrated Time Value of Money Application: Settlement Options

Scenario:

Attorney Reeves represents a client in a personal injury settlement involving long-term compensation options. The defense offers three possible settlement structures, and Reeves must determine which provides the highest present value to the client, assuming a 6% annual discount rate and no taxes.

Option A – Immediate Payout: Receive $300,000 immediately.

Option B – Deferred Lump Sum: Receive $600,000 in 12 years.

Option C – Structured Annuity: Receive $70,000 per year for 8 years, with the first payment one year from now.

- Compute the present value of each option, showing Excel functions used.

- Determine which settlement option has the highest present value.

- Briefly explain how understanding present value helps attorneys evaluate settlement offers that differ in timing or structure.