Attorneys use present value single amount calculations in various legal contexts to evaluate the current worth of future payments.

Now consider what happens if the interest is compounded more frequently than annually.

Example: Education Fund Promise with Semi-annual Compounding

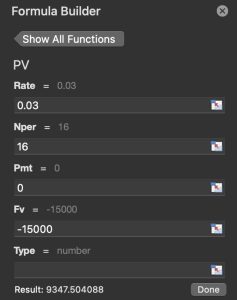

Sophia promises to give her niece $15,000 when she turns 21, which will be in 8 years and interest is compounded semiannually instead of annually. In this case, you divide the interest rate and double the number of periods:

- Rate per period = 6% ÷ 2 = 3% = 0.03

- Total periods = 8 × 2 = 16

Use the adjusted formula:

PV = FV/(1+r/2)^n*2 = $15,000/(1+0.06/2)^8*2 = $9,347.50

So, the promise to pay $15,000 in 8 years, compounding semi-annually, is worth about $9,347.50 today. With more frequent compounding, the present value is slightly lower because the money would earn interest more often if invested today.

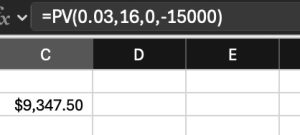

You can calculate this in Excel with:

=PV(0.03, 16, 0, -15000)

PRESENT VALUE OF MULTIPLE AMOUNTS

Here are common situations where an attorney would use present value (PV) of annuities (i.e., multiple amounts that are the same) in practice:

- Charitable Endowments: Attorneys advising donors on endowing fellowships, scholarships, or chairs calculate the present value of an annuity to determine the necessary gift amount, factoring in inflation-based annual increases.

- Family Foundations or Legacy Trusts: When setting up long-term family trusts with inflation-adjusted annual disbursements, lawyers use the PV of an annuity to plan the initial contribution needed to sustain the payouts.

- Corporate Governance and Nonprofit Funding: Attorneys representing universities, hospitals, or nonprofit boards may calculate how much a permanent funding source must contribute today to generate an income stream for operations.

- Long-Term Royalty or Licensing Agreements: If a client receives royalty payments over time (e.g., tied to inflation), attorneys use the present value of an annuity to assess buyouts or asset transfers.

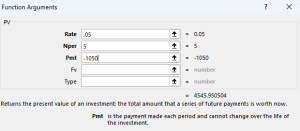

Suppose someone offers to pay you $1,050 per year for 5 years, with the first payment one year from now. If the annual interest rate is 5%, how much are those five payments worth today?

Using the present value of an ordinary annuity formula:

PV = PMT × ((1−(1+r)−n)/r)

Where:

- PV = Present Value

- PMT = Annual payment

- r = Annual interest rate

- n = Number of years

Using the example above, the calculation would be:

PV = $1,050×(1−(1+0.05)−5/0.05) = $1,050×4.32948 = $4,545.95

The present value of receiving $1,050 annually for 5 years, at a 5% interest rate, is approximately $4,545.95. This reflects the total worth today of the anticipated future payments.

In Excel, the formula function would show the following fields:

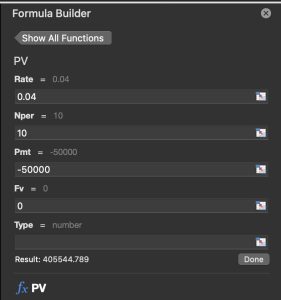

An attorney represents a client in a personal injury case. The defendant offers to settle by paying the client $50,000 annually for 10 years, rather than offering a lump-sum payment today. The attorney wants to evaluate the present value of those payments to determine whether the structured settlement is financially fair. The appropriate discount rate (interest rate) is 4%, based on current market conditions.

Using the present value formula:

PV = PMT × ((1−(1+r)−n)/r)

Where:

-

PMT = $50,000 (annual payment)

-

r = 0.04 (annual discount rate)

-

n = 10 years

PV = $50,000 × ((1−(1+0.04)−10/0.04) = $50,000 × ((1−0.67556)/0.04) =

$50,000 × ((0.32444)/0.04) = $50,000 × 8.111 = $405,545

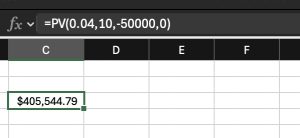

In Excel, the calculation would look as follows:

=PV(0.04, 10, 0, -50000)

The present value of the 10-year annuity at a 4% discount rate is approximately $405,545. This tells the attorney that if the client were to receive a lump sum today, a fair amount would be around $405,545, allowing the client to make an informed decision about accepting the structured settlement or negotiating for a larger upfront payment.

PERPETUAL ANNUITIES

So far, we’ve examined annuities with a set duration. However, a perpetual annuity (or perpetuity) is structured to continue indefinitely. Because the original principal must remain untouched, the investor may only withdraw the interest earned each period to ensure the payments last forever. The equation to calculate the perpetuity is:

PV = Annual Payment/Interest Rate

Example: Retirement Planning with a Perpetuity

Jordan is preparing for retirement and wants to receive $75,000 annually for the rest of his life, leaving the principal intact to provide the same payments to his heirs. If he expects a 5% annual return, how much does he need to invest?

Using the formula for the present value of a perpetuity:

PV = Annual Payment/Interest Rate =

$75,000/(0.05) = $1,500,000

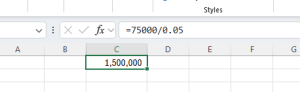

In Excel, the calculation is shown as:

Jordan would need to invest $1.5 million at 5% to receive $75,000 per year indefinitely.

In some cases, a perpetual annuity grows over time (e.g., to match inflation). The present value of a perpetuity that grows at a constant rate is calculated as follows:

PV = Payment/ (Interest Rate – Growth Rate)

Example: Endowed Legal Fellowship

Attorney Maya wants to endow a legal fellowship at her alma mater that pays $50,000 per year and increases 3% annually to keep pace with inflation. If the law school’s investment fund is expected to earn 7% annually, how much must Maya contribute?

PV = Payment/ (Interest Rate – Growth Rate) =

$50,000/(0.07-0.03) = 50,000/(0.04) = $1,250,000

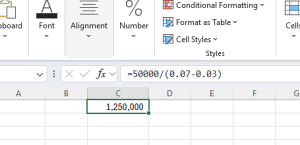

In Excel, the calculation would be:

Maya must donate $1.25 million to fund the growing annual fellowship in perpetuity.