Ch. 6 Budgets

6.1 Purpose of Budgets

Learning Objectives

After finishing this section, students will be able to:

- Understand the advantage of budgets.

- Know the difference between top-down and bottom-up budget approaches.

Personal budgets are different than just knowing what you spend. Many people feel like budgets prohibit you from spending money. If you look at a budget as a guide to how you should spend your money, you will soon learn that wealth is easy to accumulate. As you start to accumulate wealth (even if it is $1,000 in your savings account with no credit card debt), your anxiety will be lower.

Advantages of Budgeting

An important step in the initiation of a company’s strategic plan is the creation of a budget. A good budgeting system will help a company reach its strategic goals by allowing management to plan and to control major categories of activity, such as revenue, expenses, and financing options. There are many advantages to budgeting, including:

- Communication

- Budgeting is a formal method to communicate a company’s plans to its internal stakeholders, such as executives, department managers, and others who have an interest in, or responsibility for monitoring the company’s performance.

- Budgeting requires managers to plan for both revenues and expenses by communication with key department employees.

- Planning

- Preparing a budget requires managers to consider and evaluate:

- The assumptions used to prepare the budget.

- Long-term financial goals.

- Short-term financial goals.

- The company’s position in the market.

- How each department supports the strategic plan.

- Preparing a budget requires departments to work together to:

- Determine realizable sales goals.

- Compute the manufacturing or other requirements necessary to meet the sales goals.

- Solve bottlenecks that are predicted by the budget.

- Allocate resources so they can be used effectively to meet the sales and manufacturing goals.

- Compare forecasted or flexible budgets with actual results.

- Preparing a budget requires managers to consider and evaluate:

- Evaluation

- When compared to actual results, budgets are early alerts, and they forecast:

- Cash flows for various levels of production.

- When loans may be required or when loans may be reduced.

- Budgets show which areas, departments, units, and so forth, are profitable or meet their appropriate goals. Similarly, they also show which components are unprofitable or do not reach their anticipated goals.

- Budgets set defined benchmarks that may be used for evaluating company and management performance, including raises and bonuses, as well as negative consequences, such as firing.

- When compared to actual results, budgets are early alerts, and they forecast:

Budget Management

Management begins with a vision of the future. The long-term vision helps determine the direction of the company. The vision develops into goals and strategies that are built into the budget and are directly or indirectly reflected in the master budget.

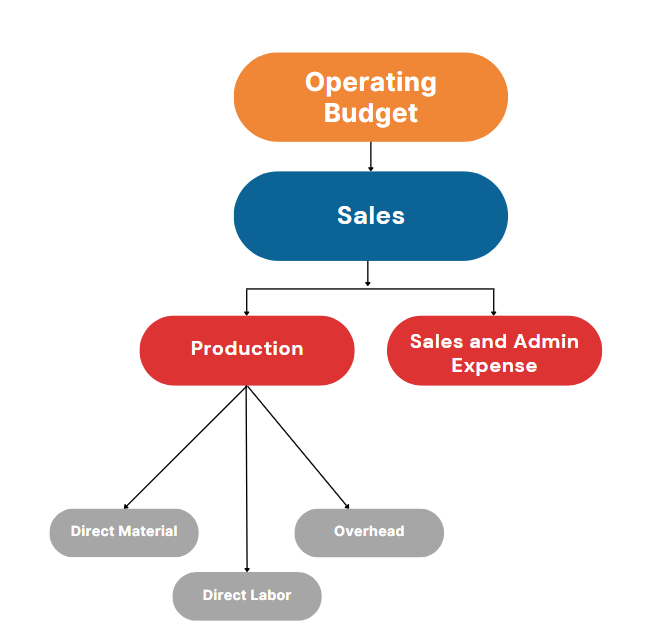

The master budget has two major categories: the financial budget and the operating budget. The financial budget plans the use of assets and liabilities and results in a projected balance sheet. The operating budget helps plan future revenue and expenses and results in a projected income statement. The operating budget has several subsidiary budgets that all begin with projected sales. For example, management estimates sales. It then breaks down estimated sales into quarters, months, and weeks and prepares the sales budget. The sales budget is the foundation for other operating budgets. Management uses the number of units from the sales budget and the company’s inventory policy to determine how many units need to be produced. This information, expressed in both units and dollars, becomes the production budget.

The production budget is calculated by completing budgets for materials, labor, and overhead, which use the standard quantity and standard price for raw materials that need to be purchased, the standard direct labor rate and the standard direct labor hours that need to be scheduled, and the standard costs for all other direct and indirect operating expenses. Companies use the historic quantities of the amount of material per unit and the hours of direct labor per unit to compute a standard used to estimate the quantity of materials and labor hours needed for the expected level of production. Current costs are used to develop standard costs for the price of materials, the direct labor rate, as well as an estimate of overhead costs.

The budget development process results in various budgets for various purposes, such as revenue, expenses, or units produced, but they all begin with a plan. To save time and eliminate unnecessary repetition, management often starts with the current year’s budget and adjusts it to meet future needs. There are various strategies companies use in adjusting the budget amounts and planning for the future.

In the top-down approach, management must devote attention to efficiently allocating resources to ensure that expenses are not padded to create budgetary slack. The drawback to this approach to budgeting is that the budget is prepared by individuals who are not familiar with specific operations and expenses and lack an understanding of each department’s nuances.

The bottom-up approach (sometimes also named a self-imposed or participative budget) begins at the lowest level of the company. After senior management has communicated the expected departmental goals, the departments then plan and predict their sales and estimates the amount of resources needed to reach these goals. This information is communicated to the supervisor, who then passes it on to upper levels of management. The advantages of this approach are that managers feel their work is valued and that knowledgeable individuals develop the budget with realistic numbers. Therefore, the budget is more likely to be attainable. The drawback is that managers may not fully understand or may misunderstand the strategic plan.

6.1a Homework

Every company should have a budget, but not every company does. Each company takes a different approach to how they create a budget.

Instructions:

Ask your current company’s accounting department if they have a budget for the current year. If they have a budget, write a paragraph about the company’s budget process. If they do not have a budget, write a paragraph explaining why they choose not to have a budget.

If you do not currently have a job, research how to create a budget for your industry. Write a paragraph explaining what you learned.

Licensing and Attribution:

Content on this page is adapted from the following openly licensed resource(s):

Principles of Accounting, Volume 2: Managerial Accounting by Mitchell Franklin, Patty Graybeal, and Dixon Cooper licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License