Ch. 6 Budgets

6.5 Proforma Income Statement

Learning Objectives

After finishing this section, students will be able to:

- Create a Proforma Income Statement.

We can use all the schedules created earlier in this chapter to create a Proforma Income Statement. Proforma means budgeted.

Budgeted Income Statement

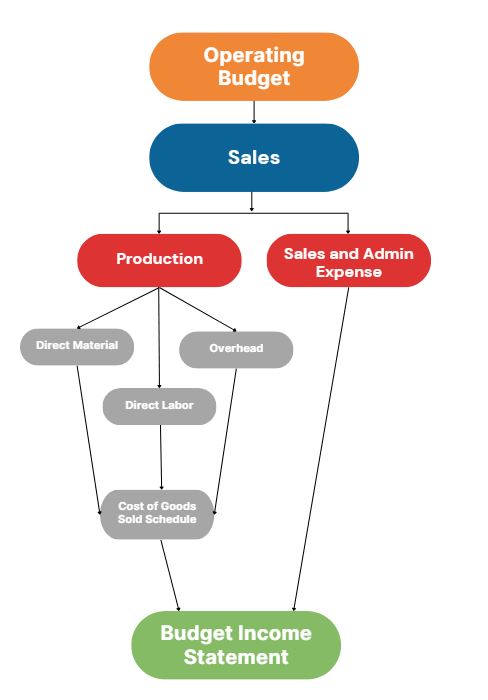

A proforma income statement is formatted similarly to a traditional income statement except that it contains budgeted data. Once all of the operating budgets have been created, these costs are used to prepare a budgeted income statement and budgeted balance sheet. The manufacturing costs are allocated to the cost of goods sold and the ending inventory.

Big Bad Bikes uses the information on direct materials, direct labor, and manufacturing overhead to allocate the manufacturing costs between the cost of goods sold and the ending work in process inventory. To remember how to create a cost of goods sold schedule, see 5.1 Cost of Goods Sold Schedule.

Once the allocation is performed, the budgeted income statement can be prepared. Big Bad Bikes estimates an interest of $4,039. It also estimates that $22,000 of its income will not be collected and will be reported as uncollectible expense. The budgeted income statement is shown below.

| Big Bad Bikes | ||

| Proforma Income Statement | ||

| For the Year Ended December 31, 20×9 | ||

| Revenue | $440,000 | |

|---|---|---|

| Cost of Good Sold | 226,200 | |

| Gross Margin | 213,800 | |

| Selling, General, and Administrative Expenses | 109,000 | |

| Income Before Taxes | 104,800 | |

| Interest Expense | 4,039 | |

| Tax Expense | 22,008 | |

| Net Income | $78,753 | |

Using the information for Monica’s Microphones, create a proforma income statement for October and November.

| Transaction | Information |

|---|---|

| A | October sales are estimated to be $370,000. The company expects sales to increase at 30% each month. Sales are 40% cash and 60% on account. Monica’s expects to collect 100% of credit sales in the month following the sale. |

| B | Cost of goods sold is 55% of sales. The company desires to maintain a minimum ending inventory equal to 25% of the next month’s cost of goods sold. However, the company wants to have more cash available at the end of November and only have an ending inventory value of $12,750. All purchases are made on account and are paid at 75% in the month purchased and 25% in the following month. |

| C | Store fixtures are purchased on October 1 for $185,400. The fixtures have a salvage value of $5,400 and a four year useful life. |

| D | Budgeted selling and administrative expenses per month are: salaries expense, $18,300; sales commission, 4% of sales; other admin expense, 2% of sales; utilities, $1,700; depreciation on store fixtures, (calculate based on Transaction D); rent, $5,100; and miscellaneous, $1,500. |

| E | Utilities and sales commissions are paid the month after they incurred. All other expenses are paid in the month in which they are incurred. |

| F | The company desires to maintain a $15,000 cash cushion. (Note: If you did not watch the example video, you will not be able to solve this until you have completed the cash budget.) |

| G | Monica’s has a line of credit that allows them to borrow funds, in increments of $1,000, and repay funds, in any amount available, on the first day of the month. The line of credit charges interest of 24% per month. The interest is paid on the first day of the next month. (Note: If you did not watch the example video, you will not be able to solve this until you have completed the cash budget.) |

6.5a Homework

The following information is for next year’s budget for Friend’s Coffee Factory.

| Transaction | Information |

|---|---|

| A | April sales are estimated to be $350,000. The company expects sales to increase at 30% each month. Sales are 50% cash and 50% on account. Friend’s expects to collect 100% of credit sales in the month following the sale. |

| B | Cost of goods sold is 60% of sales. The company desires to maintain a minimum ending inventory equal to 20% of the next month’s cost of goods sold. However, the company wants to have more cash available at the end of June and only have an ending inventory value of $10,250. All purchases are made on account and are paid at 70% in the month purchased and 30% in the following month. |

| C | Store fixtures are purchased on April 1 for $126,200. The fixtures have a salvage value of $23,000 and a two year useful life. |

| D | Budgeted selling and administrative expenses per month are: salaries expense, $15,300; sales commission, 4% of sales; other admin expense, 2% of sales; utilities, $1,500; depreciation on store fixtures, (calculate based on Transaction C); rent, $4,100; and miscellaneous, $1,700. |

| E | Utilities and sales commissions are paid the month after they incurred. All other expenses are paid in the month in which they are incurred. |

| F | The company desires to maintain a $10,000 cash cushion. (Note: If you did not watch the example video, you will not be able to solve this until you have completed the cash budget.) |

| G | Friend’s has a line of credit that allows them to borrow funds, in increments of $1,000, and repay funds, in any amount available, on the first day of the month. The line of credit charges interest of 12% annual. The interest is paid on the first day of the next month. (Note: If you did not watch the example video, you will not be able to solve this until you have completed the cash budget.) |

Instructions

- Create a Proforma Income Statement for April, May, and June 20X4. Interest Expense cannot be calculated until the Proforma Cash Budget is created in 6.6a.

Licensing and Attribution:

Content on this page is adapted from the following openly licensed resource(s):

Principles of Accounting, Volume 2: Managerial Accounting by Mitchell Franklin, Patty Graybeal, and Dixon Cooper licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License

means budgeted.

is formatted similarly to a traditional income statement except that it contains budgeted data.