Ch. 5 Cost Components and Cost-Volume-Profit

5.1 Cost of Goods Sold Schedule

Learning Objectives

After finishing this section, students will be able to:

- Realize the complexity of inventory moving through a company.

- Create a Schedule of Cost of Goods Sold.

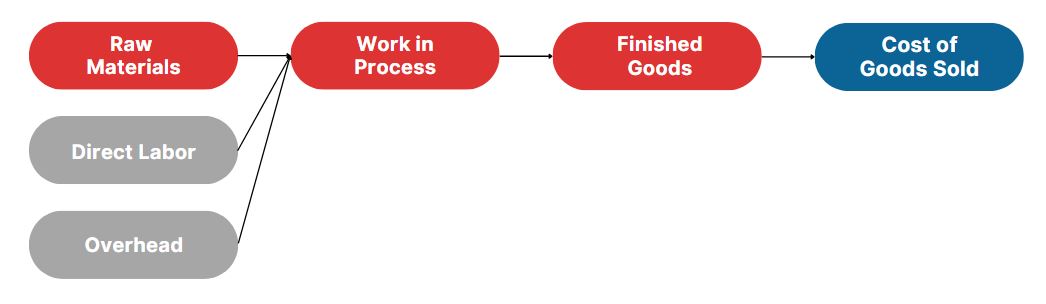

There are three types/stages of inventory that need to be tracked in a production facility: raw materials, work in process, and finished goods. In most production facilities, the raw materials are moved from the raw materials inventory into the work in process inventory. The work in process inventory involves one or more production departments and is where labor and overhead are used to convert the raw materials into finished goods inventory. At this stage, the completed products are transferred into the finished goods inventory account. When the product is sold, the costs move from the finished goods inventory into the cost of goods sold.

While many types of production processes could be demonstrated, let’s consider an example in which a contractor is building a home for a client. The accounting system will track direct materials, such as lumber. The accounting system through the payroll function will track direct labor, such as the wages paid to the carpenters constructing the home. Along with these direct materials and labor, the project will incur manufacturing overhead costs, such as indirect materials, indirect labor, and other miscellaneous overhead costs. Samples of these costs include indirect materials, such as nails, indirect labor, such as the supervisor’s salary, assuming that the supervisor is overseeing several projects at the same time, and miscellaneous overhead costs such as depreciation on the equipment used in the construction project.

As direct materials, direct labor, and overhead are introduced into the production process, they become part of the work in process inventory value. When the home is completed, the accumulated costs become part of the finished goods inventory value, and when the home is sold, the finished goods value of the home becomes the cost of goods sold.

Cost of Goods Sold Schedule

The Cost of Goods Sold Schedule is the total manufacturing costs for the period that were added to work‐in‐process and adjusts these costs for the change in the work‐in‐process inventory account to calculate the cost of goods manufactured. Let’s look at an example to understand.

At the beginning of the month, Dinosaur Vinyl had a beginning raw materials inventory balance of $2,500, and during the month, it purchased an additional $10,500.

The following example will examine four different production jobs. Each of the four will be at either the beginning of the current month or the end of the current month.

- Job POR 143: This job was the only work in process inventory at the beginning of the current month, and it had $1,000 in direct material costs, and $0 of direct labor costs already allocated to the work in process inventory. During the current month, additional direct materials of $200 and direct labor of $150 were added to POR143. An overhead cost of $375 was applied to POR143 at the predetermined overhead rate of $2.50 per direct labor dollar. It was finished during the month and transferred to the finished goods inventory. The sale was not finalized during the month, so it continues to be part of the finished goods inventory.

- Job MAC 001: This job was started and completed during the month. Since the job began and was completed in the same month, there was no beginning balance in the work in process inventory. During the month it incurred $700 in direct materials costs, $66 in direct labor, and $165 of overhead applied to the job before it was transferred to the finished goods inventory upon completion. The sale was finalized during the month at a sale price of $2,000, so the costs were transferred from finished goods inventory to cost of goods sold.

- Job TRJ441: This job was started during the current month. Its costs consist of $500 in direct material cost, $150 in direct labor expenses, and $375 in applied overhead. The job remains in work in process inventory awaiting assembly.

- Job SWM505: At the beginning of the month, this job was completed and already in the finished goods inventory at a cost of $1,531. Since it was completed, it has not incurred any additional costs in the current month. It was sold during the month for $3,500, and the costs were transferred from the finished goods inventory to cost of goods sold.

That was a lot of information to process. For this reason, we are thankful for cost accountants and should be nice to them. If each job is put into one schedule, the outcome would be the Cost of Goods Sold Schedule as follows:

| Account | Amount |

|---|---|

| Beginning Raw Materials | $2,500 |

| + Purchases | 10,500 |

| – Ending Raw Materials | 11,600 |

| Direct Materials Used | 1,400 |

| + Direct Labor | 366 |

| + Overhead | 915 |

| Total Manufacturing Costs | 2,681 |

| + Beginning Work in Process Inventory | 1,000 |

| – Ending Work in Process Inventory | 1,025 |

| Cost of Goods Manufactured | 2,656 |

| + Beginning Finished Goods Inventory | 1,531 |

| – Ending Finished Goods Inventory | 1,725 |

| Cost of Goods Sold | $2,462 |

Raw Materials Inventory

Raw materials inventory is the total cost of materials that will be used in the production process. Usually, several accounts make up the raw materials inventory, and these can be actual accounts or accounts subsidiary to the general raw materials inventory account. In our example, Dinosaur Vinyl has several raw materials accounts: vinyl, red ink, black ink, gold ink, grommets, and wood.

Within the raw materials inventory account, purchases increase the inventory, whereas raw materials sent into production reduce it. It is easy to reconcile the amount of ending inventory and the cost of direct materials used in production. Since the costs are transferred with production, the calculation shows the amount of materials used in production:

Beg Raw Materials + Purchases – End raw materials = Direct Materials Used

| Account | Amount |

|---|---|

| Beginning Raw Materials | $2,500 |

| + Purchases | 10,500 |

| – Ending Raw Materials | 11,600 |

| Direct Materials Used | 1,400 |

Manufacturing Costs

The three general categories of costs included in manufacturing processes are direct materials, direct labor, and overhead. These amounts added together are the total manufacturing costs. These concepts will be discussed in depth in the next section.

Direct Materials Used + Direct Labor + Overhead = Total Manufacturing Costs

| Account | Amount |

|---|---|

| Direct Materials Used | 1,400 |

| + Direct Labor | 366 |

| + Overhead | 915 |

| Total Manufacturing Costs | 2,681 |

Work in Process Inventory

The balance in the work in process inventory account is continually updated and is the total of all unfinished jobs. The production cycle is a continuous cycle that begins with raw materials, direct labor, and overhead being transferred to work in process, moving through production, and ending as finished goods inventory. Typically, as goods are being produced, additional jobs are being started and finished, and the work in process inventory includes jobs still in production at the end of the accounting period. At the end of the accounting cycle, there will be jobs that remain unfinished in the production cycle, and these represent the work in process inventory.

Total Manufacturing Costs + Beg Work in Process – End Work in Process = Cost of Goods Manufactured

| Account | Amount |

|---|---|

| Total Manufacturing Costs | 2,681 |

| + Beginning Work in Process Inventory | 1,000 |

| – Ending Work in Process Inventory | 1,025 |

| Cost of Goods Manufactured | 2,656 |

Finished Goods Inventory

After each job has been completed and overhead has been applied, the product is transferred to the finished goods inventory where it stays until it is sold. As a result, all inventory accounts are constantly maintained. The materials inventory balance is continually updated, as materials are purchased and requisitioned for individual jobs. The work in process inventory and finished goods inventory are master accounts, and their balances are determined by adding the total of the job cost sheets. The total of the incomplete jobs becomes the total work in process inventory, and the total of the completed and unsold jobs becomes the total of the finished goods inventory. The cost of goods sold is the manufacturing cost of the items sold during the period. It is calculated by adding the beginning finished goods inventory and the cost of goods manufactured to arrive at the cost of goods available for sale. The cost of goods available for sale less the ending inventory results in the cost of goods sold. The cost of goods sold is the manufacturing cost of the items sold during the period. Similar to the raw materials and work in process inventories, the cost of goods sold can be calculated as shown:

Cost of Goods Manufactured + Beg Finished Goods – End Finished Goods = Cost of Goods Sold

| Account | Amount |

|---|---|

| Cost of Goods Manufactured | 2,656 |

| + Beginning Finished Goods Inventory | 1,531 |

| – Ending Finished Goods Inventory | 1,725 |

| Cost of Goods Sold | $2,462 |

Solve the missing information for Strange Company

| Beginning Raw Materials | ???? |

|---|---|

| + Purchases | 9,800 |

| – Ending Raw Materials | 23,000 |

| Direct Materials Used | 11,800 |

| + Direct Labor | ???? |

| + Overhead | 18,000 |

| Total Manufacturing Costs | 55,800 |

| + Beginning Work in Process Inventory | 17,500 |

| – Ending Work in Process Inventory | ???? |

| Cost of Goods Manufactured | 53,700 |

| + Beginning Finished Goods Inventory | 12,300 |

| – Ending Finished Goods Inventory | 11,600 |

| Cost of Goods Sold | ???? |

5.1a Practice

The following information pertains to Joey’s Costumes for October 20XX.

| October 1 Inventory Balances | |

|---|---|

| Raw materials | $103,700 |

| Work in process | 122,500 |

| Finished goods | 78,400 |

| October 31 Inventory Balances | |

| Raw materials | 61,300 |

| Work in process | 146,500 |

| Finished goods | 80,300 |

| During October | |

| Costs of raw materials purchased | 120,300 |

| Costs of direct labor | 180,900 |

| Costs of manufacturing overhead | 205,100 |

| Sales revenues | 610,650 |

Instructions

- Prepare a schedule of cost of goods manufactured and sold.

- Calculate the amount of gross margin on the income statement.

Key Figures

- Total Manufacturing Costs, $548,700

- Cost of Goods Sold, $522,800

- Solution (Excel file will download)

5.1a Homework

The following information pertains to The Taffy Store for March 20XX.

| March 1 Inventory Balances | |

|---|---|

| Raw materials | $101,200 |

| Work in process | 120,000 |

| Finished goods | 78,000 |

| March 31 Inventory Balances | |

| Raw materials | 58,800 |

| Work in process | 145,000 |

| Finished goods | 80,000 |

| During March | |

| Costs of raw materials purchased | 118,800 |

| Costs of direct labor | 100,000 |

| Costs of manufacturing overhead | 63,000 |

| Sales revenues | 381,200 |

Instructions

- Prepare a schedule of cost of goods manufactured and sold.

- Calculate the amount of gross margin on the income statement.

Licensing and Attribution:

Content on this page is adapted from the following openly licensed resource(s):

Principles of Accounting, Volume 2: Managerial Accounting by Mitchell Franklin, Patty Graybeal, and Dixon Cooper licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License

is the total manufacturing costs for the period that were added to work‐in‐process, and adjusts these costs for the change in the work‐in‐process inventory account to calculate the cost of goods manufactured.

is the total cost of materials that will be used in the production process.

are direct materials, direct labor, and overhead added together.

is the account that tracks inventory ready to sell.