Ch. 2 Financial Statements and Adjusting Entries

2.5 Debits and Credits

Learning Objectives

After finishing this section, students will be able to:

- use debits and credits to process accounting transactions.

So far in the textbook, we have learned the horizontal model approach. This approach allows you to easily see how transactions affect the financial statements which in turn gives a better understanding of financial statements. In accounting information systems, the computer language used is debits and credits

In accounting, debits and credits are the two fundamental aspects of every financial transaction. Every transaction affects at least two accounts — one is debited, and the other is credited. The total amount of debits must always equal the total amount of credits.

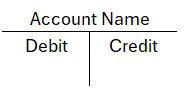

A T-account is a visual aid used in accounting to represent individual ledger accounts. It looks like a “T”. The left side is the Debit side. The right side is the Credit side.

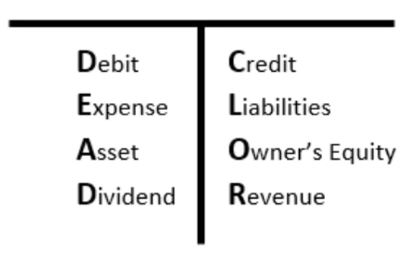

The normal balance of an account is the side (debit or credit) that increases that account. It’s also the side where the account usually has its ending balance.

We have learned that classifications, see 1.2 Accounting Quick Reference and Terms, help us know what report an account goes one. We will use the same approach with Debits and Credits by learning the memory trick DEAD CLOR.

To understand more about how to use DEAD CLOR, please watch this video.

To understand how to create journal entries, we will use the transactions from 2.1 Review of Horizontal Model.

The following transactions occur for the first month, January 20X9, of operations for Printing Plus, a printing service company.

| Date | Transaction |

|---|---|

| Jan. 3 | Issues $20,000 shares of common stock for cash. |

| Jan. 5 | Purchases equipment on account for $3,500, payment due within the month. |

| Jan. 9 | Receives $4,000 cash in advance from a customer for services not yet rendered. |

| Jan. 10 | Provides $5,500 in services to a customer who asks to be billed for the services. |

| Jan. 12 | Pays a $300 utility bill with cash. |

| Jan. 14 | Distributes $100 cash in dividends to stockholders. |

| Jan. 17 | Receives $2,800 cash from a customer for services rendered. |

| Jan. 18 | Pays in full, with cash, for the equipment purchase on January 5. |

| Jan. 20 | Pays $3,600 cash in salaries expense to employees. |

| Jan. 23 | Receives cash payment in full from the customer on the January 10 transaction. |

| Jan. 27 | Provides $1,200 in services to a customer who asks to be billed for the services. |

| Jan. 30 | Purchases inventory on account of $500, payment due within three months. |

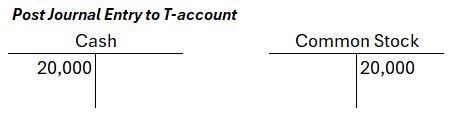

Transaction Jan. 3

Issues $20,000 shares of common stock for cash.

Source Document: Share Certificate

| Balance Sheet | Income Statement | Stmt of Cash Flows | |||||||||||||

| Cash | + | Noncash Assets | = | Liability | + | Common Stock | + | Retained Earnings | Revenue | – | Expense | = | Net Income | Cash | OA,IA,FA |

| 20,000 | = | 20,000 | 20,000 | FA | |||||||||||

| Journal Entry | ||

| Cash | 20,000 | |

| Common Stock | 20,000 |

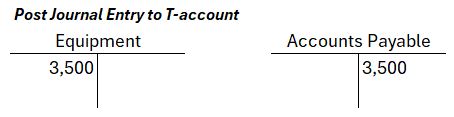

Transaction Jan. 5

Purchases equipment on account for $3,500, payment due within the month. Accounts Payable is a liability and is used to keep track of vendor bills to be paid later. An easy way to remember this is that you are liable to pay the vendors for items purchased.

Source Document: Invoice

| Balance Sheet | Income Statement | Stmt of Cash Flows | |||||||||||||

| Cash | + | Equipment | = | Accounts Payable | + | Common Stock | + | Retained Earnings | Revenue | – | Expense | = | Net Income | Cash | OA,IA,FA |

| 3,500 | = | 3,500 | |||||||||||||

| Journal Entry | ||

| Equipment | 3,500 | |

| Accounts Payable | 3,500 |

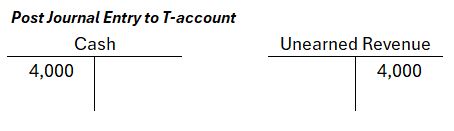

Transaction Jan. 9

Receives $4,000 cash in advance from a customer for services not yet rendered. Unearned Revenue is a liability used to keep track of payments customers have paid before the service is provided. Because the service has not been provided, it cannot be put on the income statement. If you do not provide the service for the customers, you are liable to pay the customers back.

Source Document: Customer Check

| Balance Sheet | Income Statement | Stmt of Cash Flows | |||||||||||||

| Cash | + | Noncash Assets | = | Unearned Revenue | + | Common Stock | + | Retained Earnings | Revenue | – | Expense | = | Net Income | Cash | OA,IA,FA |

| 4,000 | = | 4,000 | 4,000 | OA | |||||||||||

| Journal Entry | ||

| Cash | 4,000 | |

| Unearned Revenue | 4,000 |

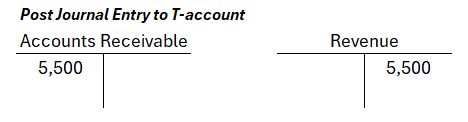

Transaction Jan. 10

Provides $5,500 in services to a customer who asks to be billed for the services. Accounts Receivable is used to keep track of the money customers owe. An easy way to remember this is you will receive money from customers. The service has been provided so the revenue can be put on the income statement.

Source Document: Work Order returned from service tech

| Balance Sheet | Income Statement | Stmt of Cash Flows | |||||||||||||

| Cash | + | Accounts Receivable | = | Liability | + | Common Stock | + | Retained Earnings | Revenue | – | Expense | = | Net Income | Cash | OA,IA,FA |

| 5,500 | = | 5,500 | 5,500 | – | = | 5,500 | |||||||||

| Journal Entry | ||

| Accounts Receivable | 5,500 | |

| Revenue | 5,500 |

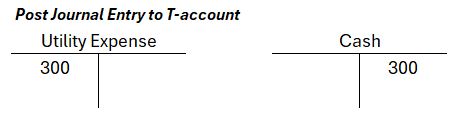

Transaction Jan. 12

Pays a $300 utility bill with cash.

Source Document: Utility Bill

| Balance Sheet | Income Statement | Stmt of Cash Flows | |||||||||||||

| Cash | + | Noncash Assets | = | Liability | + | Common Stock | + | Retained Earnings | Revenue | – | Utility Expense | = | Net Income | Cash | OA,IA,FA |

| -300 | = | -300 | – | 300 | = | -300 | -300 | OA | |||||||

| Journal Entry | ||

| Utility Expense | 300 | |

| Cash | 300 |

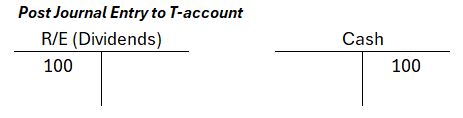

Transaction Jan. 14

Distributes $100 cash in dividends to stockholders. Remember the Retained Earnings formula is Beg R/E ($0) + Net Income ($0) – Dividends ($100) = End R/E (-$100).

Source Document: Email from Board of Directors (may vary by state)

| Balance Sheet | Income Statement | Stmt of Cash Flows | |||||||||||||

| Cash | + | Noncash Assets | = | Liability | + | Common Stock | + | Retained Earnings | Revenue | – | Expense | = | Net Income | Cash | OA,IA,FA |

| -100 | = | -100 | -100 | FA | |||||||||||

| Journal Entry | ||

| Dividends | 100 | |

| Cash | 100 |

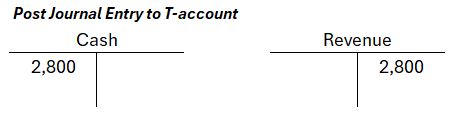

Transaction Jan. 17

Receives $2,800 cash from a customer for services rendered. The customer paid cash in full at time of the service so an entry does not need to be made in Accounts Receivable.

Source Document: Customer Check

| Balance Sheet | Income Statement | Stmt of Cash Flows | |||||||||||||

| Cash | + | Noncash Assets | = | Liability | + | Common Stock | + | Retained Earnings | Revenue | – | Expense | = | Net Income | Cash | OA,IA,FA |

| 2,800 | = | 2,800 | 2,800 | – | = | 2,800 | 2,800 | OA | |||||||

| Journal Entry | ||

| Cash | 2,800 | |

| Revenue | 2,800 |

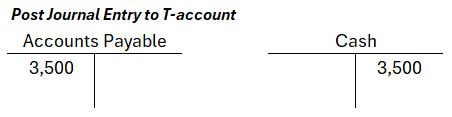

Transaction Jan. 18

Pays in full, with cash, for the equipment purchase on January 5. The purchase of the equipment has already been recorded and is tracked under Accounts Payable. As cash decreases, accounts payable also decreases because less money is owed.

Source Document: Check used for business checking account

| Balance Sheet | Income Statement | Stmt of Cash Flows | |||||||||||||

| Cash | + | Noncash Assets | = | Accounts Payable | + | Common Stock | + | Retained Earnings | Revenue | – | Expense | = | Net Income | Cash | OA,IA,FA |

| -3,500 | = | -3,500 | -3,500 | IA | |||||||||||

| Journal Entry | ||

| Accounts Payable | 3,500 | |

| Cash | 3,500 |

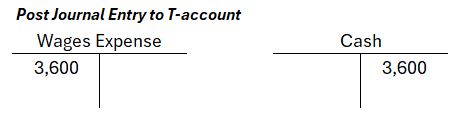

Transaction Jan. 20

Pays $3,600 cash in salaries expense to employees.

Source Document: Employee Time Card

| Balance Sheet | Income Statement | Stmt of Cash Flows | |||||||||||||

| Cash | + | Noncash Assets | = | Liability | + | Common Stock | + | Retained Earnings | Revenue | – | Wages Expense | = | Net Income | Cash | OA,IA,FA |

| -3,600 | = | -3,600 | – | 3,600 | = | -3,600 | -3,600 | OA | |||||||

| Journal Entry | ||

| Wage Expense | 3,600 | |

| Cash | 3,600 |

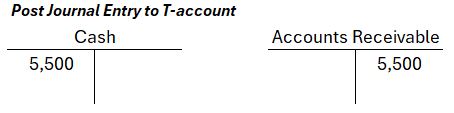

Transaction Jan. 23

Receives cash payment in full from the customer on the January 10 transaction.

Source Document: Customer Check

| Balance Sheet | Income Statement | Stmt of Cash Flows | |||||||||||||

| Cash | + | Accounts Receivable | = | Liability | + | Common Stock | + | Retained Earnings | Revenue | – | Expense | = | Net Income | Cash | OA,IA,FA |

| 5,500 | + | -5,500 | = | 5,500 | OA | ||||||||||

| Journal Entry | ||

| Cash | 5,500 | |

| Accounts Receivable | 5,500 |

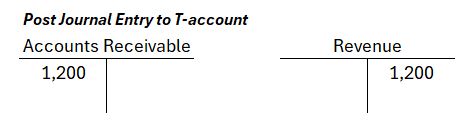

Transaction Jan. 27

Provides $1,200 in services to a customer who asks to be billed for the services.

Source Document: Work Order returned from service tech

| Balance Sheet | Income Statement | Stmt of Cash Flows | |||||||||||||

| Cash | + | Accounts Receivable | = | Liability | + | Common Stock | + | Retained Earnings | Revenue | – | Expense | = | Net Income | Cash | OA,IA,FA |

| 1,200 | = | 1,200 | 1,200 | – | = | 1,200 | |||||||||

| Journal Entry | ||

| Accounts Receivable | 1,200 | |

| Accounts Payable | 1,200 |

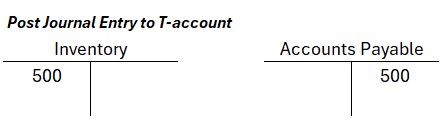

Transaction Jan. 30

Purchases inventory on account of $500, payment due within three months. Inventory is an asset you own and is tracked until an entry is made from an adjusting entry or sale of product to a customer to show the inventory has been sold. When you later pay the inventory, you will reduce how much money you owe to the vendor.

Source Document: Vendor Bill

| Balance Sheet | Income Statement | Stmt of Cash Flows | |||||||||||||

| Cash | + | Inventory | = | Accounts Payable | + | Common Stock | + | Retained Earnings | Revenue | – | Expense | = | Net Income | Cash | OA,IA,FA |

| 500 | = | 500 | |||||||||||||

| Journal Entry | ||

| Inventory | 500 | |

| Accounts Payable | 500 |

Transaction Summary

When January transactions are put into the same horizontal model, the last row can be summed up to find the account balances (in bold). In the next section, we will create adjusting entries.

| Balance Sheet | Income Statement | Stmt of Cash Flows | ||||||||||||||||||||||

| Cash | + | Accounts Receivable | + | Inventory | + | Equipment | = | Accounts Payable | + | Unearned Revenue | + | Common Stock | + | Retained Earnings | Revenue | – | Expense | = | Net Income | Cash | OA,IA,FA | Description | ||

| J3 | 20,000 | + | + | + | = | + | + | 20,000 | + | – | = | 20,000 | FA | Stock | ||||||||||

| J5 | + | + | + | 3,500 | = | 3,500 | + | + | + | – | = | – | – | Equipment | ||||||||||

| J9 | 4,000 | + | + | + | = | + | 4,000 | + | + | – | = | 4,000 | OA | Cust. Pay | ||||||||||

| J10 | + | 5,500 | + | + | = | + | + | + | 5,500 | 5,500 | – | = | 5,500 | – | – | Revenue | ||||||||

| J12 | -300 | + | + | + | = | + | + | + | -300 | – | 300 | = | -300 | -300 | OA | Utility Exp | ||||||||

| J14 | -100 | + | + | + | = | + | + | + | -100 | – | = | -100 | FA | Dividends | ||||||||||

| J17 | 2,800 | + | + | + | = | + | + | + | 2,800 | 2,800 | – | = | 2,800 | 2,800 | OA | Cust. Pay | ||||||||

| J18 | -3,500 | + | + | + | = | -3,500 | + | + | + | – | = | -3,500 | IA | Equipment | ||||||||||

| J20 | -3,600 | + | + | + | = | + | + | + | -3,600 | – | 3,600 | = | -3,600 | -3,600 | OA | Wages Exp | ||||||||

| J23 | 5,500 | + | -5,500 | + | + | = | + | + | + | – | = | 5,500 | OA | Cust. Pay | ||||||||||

| J27 | + | 1,200 | + | + | = | + | + | + | 1,200 | 1,200 | – | = | 1,200 | – | – | Revenue | ||||||||

| J30 | + | + | 500 | + | = | 500 | + | + | + | – | = | – | – | Inventory | ||||||||||

| 24,800 | + | 1,200 | + | 500 | + | 3,500 | = | 500 | + | 4,000 | + | 20,000 | + | 5,500 | 9,500 | – | 3,900 | = | 5,600 | 24,800 | Totals | |||

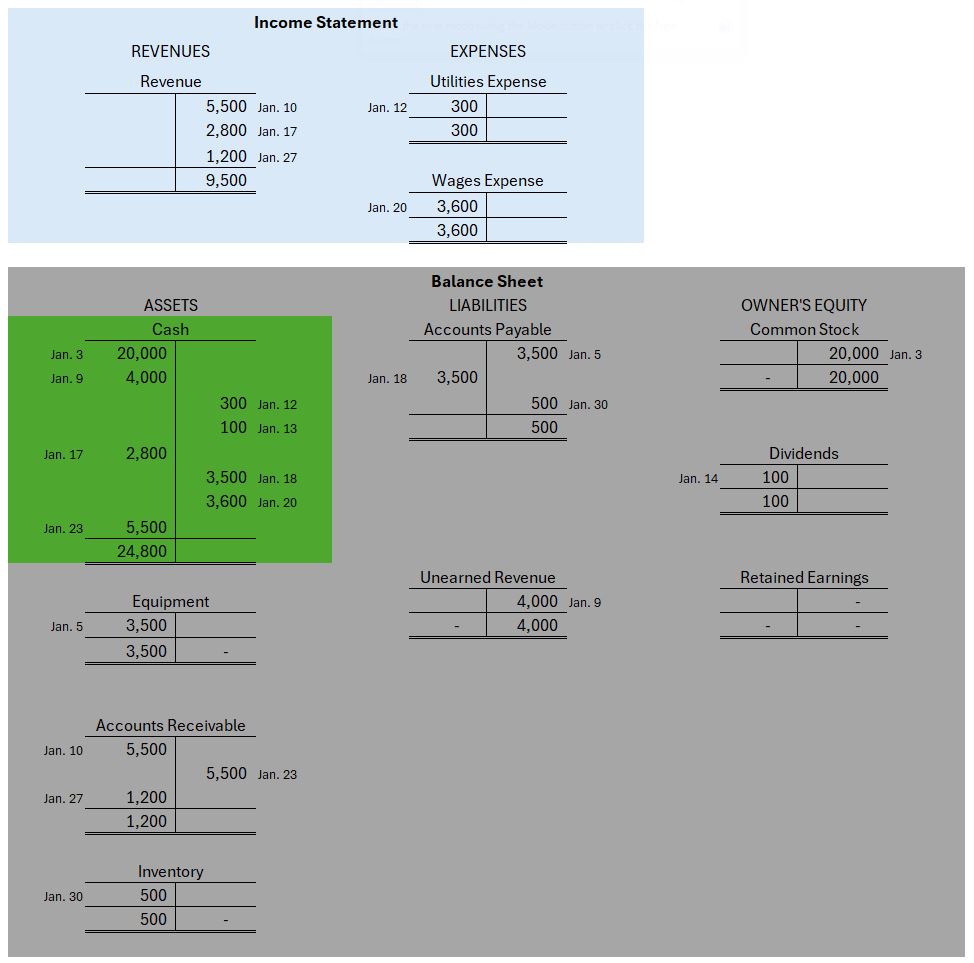

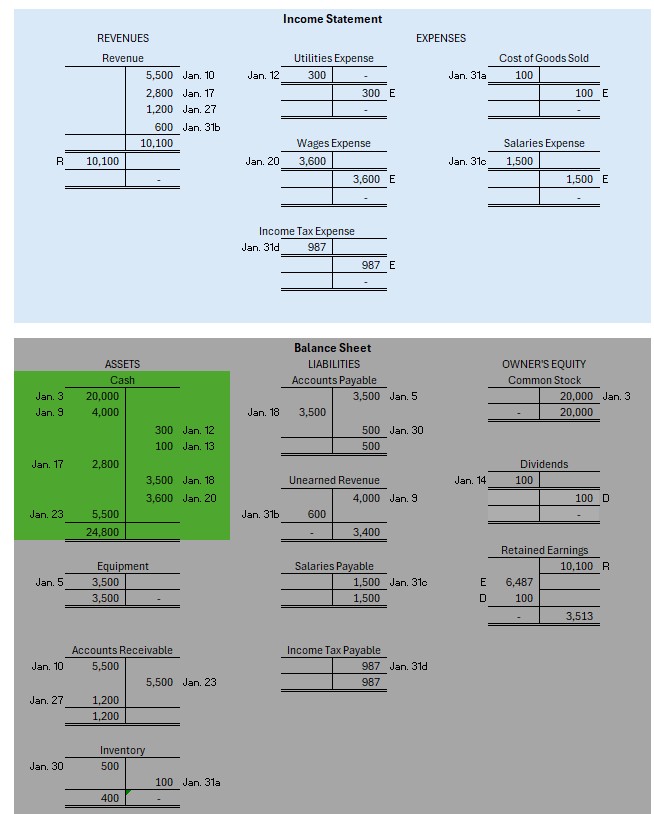

Looking at the t-account model, we would see the following t-accounts. While the t-accounts still provide the information as the horizontal model, it takes a bit more work for the human brain to decipher how t-accounts translate to financial statements.

2.5a Example

Note: Download the 2.5a&b Example to view as you listen to me talk about Debits and Credits.

Wood, Corp was created on June 1, 20X6. The company owns and operates a shoe store. The following transactions occurred.

| Date | Transaction Detail |

|---|---|

| 1 | Issued 100,000 shares of common stock in exchange for $250,000 cash. |

| 2 | Purchased fixtures (asset) at a cost of $100,000. $40,000 was paid in cash and a note payable was signed for the balance owed. |

| 3 | Paid $14,000 in rent on the building for the month of June. |

| 4 | Purchased inventory on account at a cost of $200,000. |

| 5 | Credit sales (on account) for the month totaled $280,000. |

| 6 | Paid $120,000 on account for merchandise purchased in transaction 4. |

| 7 | Collected $55,000 from customers on account billed in transaction 5. |

| 8 | Paid $2,500 for utilities expense. |

| 9 | Paid $24,000 for 12 months of insurance. |

| 10 | Paid $3,000 for advertising expense. |

| 11 | Paid dividends of $4,750. |

Instructions:

- Prepare entries for the above transactions.

2.5a Practice

Geller Enterprises had the following balances as of December 31, Year 3.

- Assets: Cash, $54,000; Accounts Receivable, $51,000; Land, $33,000

- Liabilities and Equity: Accounts Payable, $24,000; Common Stock, $103,000; Retained Earnings, 11,000

Prepare journal entries for the below transactions.

| Date | Transaction Detail |

|---|---|

| 1 | Issued 50,000 shares of common stock in exchange for $48,000 cash. |

| 2 | On March 1, paid $5,400 in advance for a one-year lease for office space. |

| 3 | Paid a $1,800 dividend to the stockholders. |

| 4 | Purchased additional land that cost $45,000. |

| 5 | Paid $12,000 of bills in accounts payable. |

| 6 | On July 1, received $7,600 in advance as a retainer for services to be performed monthly over the coming year. |

| 7 | Sold land for $22,000 cash that had an original cost of $22,000. |

| 8 | Earned $69,000 of service revenue on account during the year. |

| 9 | Collected $55,000 from customers on account. |

| 10 | Incurred other operating expenses on account during the year that amounted to $11,000. |

Check Figures:

- Cash, $122,400

- Accounts Receivable, $65,000

- Retained Earnings, $67,200

- Solution (Excel file will download)

2.5a Homework

Grazy Strokes Glass Blowers was created on August 1, 20X4. The company produces high-end vases. The following transactions occurred.

| Date | Transaction Detail |

|---|---|

| 1 | Acquired cash of $65,000 from the issue of common stock. |

| 2 | Purchased inventory on account of $25,000 |

| 3 | Purchase land costing $18,000 with cash. |

| 4 | Paid $2,200 on account for merchandise purchases in transaction 2. |

| 5 | Credit sales (on account) for the month totaled $43,000. |

| 6 | Paid cash of $18,000 for the next year’s administrative rent expenses. |

| 7 | Collected cash of $37,000 from customers in transaction 5. |

| 8 | Paid $2,200 on account for merchandise purchases in transaction 2. |

Instructions:

- Prepare journal entries for the above transactions.

Adjusting Entries

We will continue to use the transactions from above to learn adjusting journal entries. On January 31, 20X9, Printing Plus makes adjusting entries for the following transactions.

| Date | Transaction |

|---|---|

| Jan. 31a | On January 31, Printing Plus took a count of its inventory and discovered that $100 of inventory had been used during the month. |

| Jan. 31b | Printing Plus performed $600 of services during January for the customer from the January 9 transaction. |

| Jan. 31c | Employees earned $1,500 in salaries for the period of January 21–January 31 that had been previously unpaid and unrecorded. |

| Jan. 31d | Income Tax Expense is calculated at 21%. |

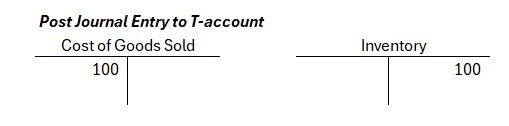

Transaction Jan. 31a

On January 31, Printing Plus took an counted its inventory and discovered that $100 of inventory had been used during the month.

Following the adjusting entry rules, we need to make sure the inventory amount on the balance sheet is correct.

- NEVER use cash. Easy enough!

- ALWAYS include one Balance Sheet account. The balance sheet account to use is inventory. When -$100 of inventory use is subtracted, inventory will be $400.

- ALWAYS include one Income Statement account. The income statement account associated with inventory is cost of good sold.

| Balance Sheet | Income Statement | Stmt of Cash Flows | ||||||||||||||||||||||

| Cash | + | Accounts Receivable | + | Inventory | + | Equipment | = | Accounts Payable | + | Unearned Revenue | + | Common Stock | + | Retained Earnings | Revenue | – | Expense | = | Net Income | Cash | OA,IA,FA | Description | ||

| 24,800 | + | 1,200 | + | 500 | + | 3,500 | = | 500 | + | 4,000 | + | 20,000 | + | 5,500 | 9,500 | – | 3,900 | = | 5,600 | 24,800 | Totals | |||

| a | – | -100 | = | -100 | – | 100 | = | -100 | – | COGS | ||||||||||||||

| Journal Entry | ||

| Cost of Goods Sold | 100 | |

| Inventory | 100 |

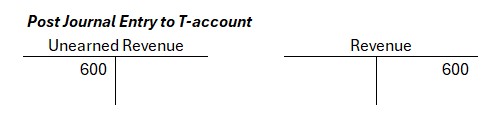

Transaction Jan. 31b

Printing Plus performed $600 of services during January for the customer from the January 9 transaction.

- NEVER use cash. Easy enough!

- ALWAYS include one Balance Sheet account. The balance sheet account to use is unearned revenue. This is the account that we originally recorded the money received from our customer.

- ALWAYS include one Income Statement account. The income statement account associated with unearned revenue is revenue.

| Balance Sheet | Income Statement | Stmt of Cash Flows | ||||||||||||||||||||||

| Cash | + | Accounts Receivable | + | Inventory | + | Equipment | = | Accounts Payable | + | Unearned Revenue | + | Common Stock | + | Retained Earnings | Revenue | – | Expense | = | Net Income | Cash | OA,IA,FA | Description | ||

| 24,800 | + | 1,200 | + | 500 | + | 3,500 | = | 500 | + | 4,000 | + | 20,000 | + | 5,500 | 9,500 | – | 3,900 | = | 5,600 | 24,800 | Totals | |||

| b | – | = | -600 | 600 | 600 | – | = | 600 | – | Revenue | ||||||||||||||

| Journal Entry | ||

| Unearned Revenue | 600 | |

| Revenue | 600 |

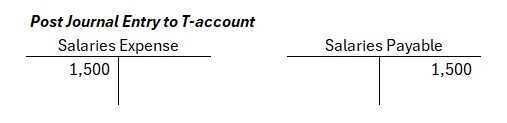

Transaction Jan. 31c

Employees earned $1,500 in salaries for the period of January 21–January 31 that had been previously unpaid and unrecorded.

- NEVER use cash. Easy enough!

- ALWAYS include one Balance Sheet account. The balance sheet account to use is salaries payable because we are obligated to pay our employees later.

- ALWAYS include one Income Statement account. The income statement account associated with salaries payable is salaries expense.

| Balance Sheet | Income Statement | Stmt of Cash Flows | ||||||||||||||||||||||||

| Cash | + | Accounts Receivable | + | Inventory | + | Equipment | = | Accounts Payable | + | Salaries Payable | + | Unearned Revenue | + | Common Stock | + | Retained Earnings | Revenue | – | Expense | = | Net Income | Cash | OA,IA,FA | Description | ||

| 24,800 | + | 1,200 | + | 500 | + | 3,500 | = | 500 | + | + | 4,000 | + | 20,000 | + | 5,500 | 9,500 | – | 3,900 | = | 5,600 | 24,800 | Totals | ||||

| c | – | = | 1,500 | -1,500 | – | 1,500 | = | -1,500 | – | Salaries Exp | ||||||||||||||||

| Journal Entry | ||

| Salaries Expense | 1,500 | |

| Salaries Payable | 1,500 |

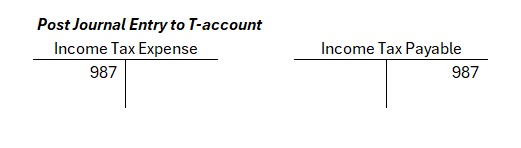

Transaction Jan. 31d

Income Tax Expense is calculated at 21%. To calculate how much income tax is owed, calculate net income after the adjusting entries have been made. Revenue (9,500 + 600) minus Expenses (3,900 + 100 + 1,500) equals Net Income of $4,700. Net Income ($4,700) x income tax rate (21%) is an income tax expense of $987,

- NEVER use cash. Easy enough!

- ALWAYS include one Balance Sheet account. The balance sheet account to use is income tax payable.

- ALWAYS include one Income Statement account. The income statement account associated with income tax payable is income tax expense.

| Balance Sheet | Income Statement | Stmt of Cash Flows | ||||||||||||||||||||||||||

| Cash | + | Accounts Receivable | + | Inventory | + | Equipment | = | Accounts Payable | + | Salaries Payable | + | Unearned Revenue | + | Income Tax Payable | + | Common Stock | + | Retained Earnings | Revenue | – | Expense | = | Net Income | Cash | OA,IA,FA | Description | ||

| 24,800 | + | 1,200 | + | 500 | + | 3,500 | = | 500 | + | + | 4,000 | + | + | 20,000 | + | 5,500 | 9,500 | – | 3,900 | = | 5,600 | 24,800 | Totals | |||||

| a | – | + | + | -100 | + | = | + | + | + | + | + | -100 | – | 100 | = | -100 | COGS | |||||||||||

| b | – | + | + | + | = | + | + | -600 | + | + | + | 600 | 600 | – | = | 600 | Revenue | |||||||||||

| c | – | + | + | + | = | + | 1,500 | + | + | + | + | – | 1,500 | = | -1,500 | Salaries Exp | ||||||||||||

| d | – | + | + | + | = | + | + | + | 987 | + | + | -987 | – | 987 | = | -987 | Income Tax Exp | |||||||||||

| Journal Entry | ||

| Income Tax Expense | 987 | |

| Income Tax Payable | 987 |

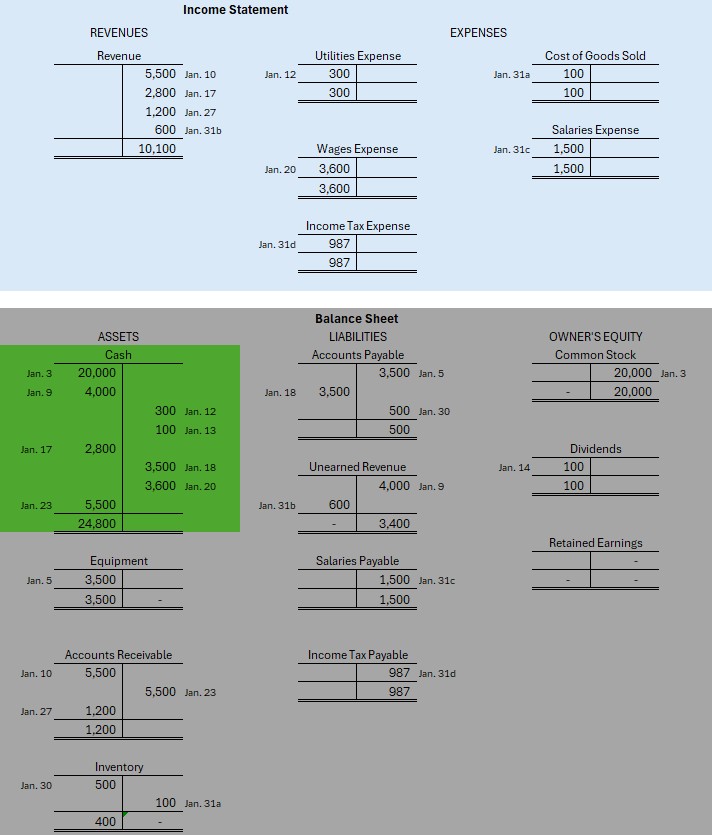

Financial Statements

When January transactions are put into the t-accounts, the sum of each t-account is the account balances that will appear on the financial statements. From the t-accounts, we will can create the financial statements found in LO 2.3.

As you create the financial statements, you will realize that the Statement of Stockholder’s Equity is needed to calculate Retained Earnings. Closing entries are taught in the last section of this learning objective to help you understand how an accounting system make Net Income appear in Retained Earnings.

| Balance Sheet | Income Statement | Stmt of Cash Flows | ||||||||||||||||||||||||||

| Cash | + | Accounts Receivable | + | Inventory | + | Equipment | = | Accounts Payable | + | Salaries Payable | + | Unearned Revenue | + | Income Tax Payable | + | Common Stock | + | Retained Earnings | Revenue | – | Expense | = | Net Income | Cash | OA,IA,FA | Description | ||

| 24,800 | + | 1,200 | + | 500 | + | 3,500 | = | 500 | + | + | 4,000 | + | + | 20,000 | + | 5,500 | 9,500 | – | 3,900 | = | 5,600 | 24,800 | Totals | |||||

| a | – | + | + | -100 | + | = | + | + | + | + | + | -100 | – | 100 | = | -100 | 0 | COGS | ||||||||||

| b | – | + | + | + | = | + | + | -600 | + | + | + | 600 | 600 | – | = | 600 | 0 | Revenue | ||||||||||

| c | – | + | + | + | = | + | 1,500 | + | + | + | + | -1500 | – | 1,500 | = | -1,500 | 0 | Salaries Exp | ||||||||||

| d | – | + | + | + | = | + | + | + | 987 | + | + | -987 | – | 987 | = | -987 | 0 | Income Tax Exp | ||||||||||

| 24,800 | + | 1,200 | + | 400 | + | 3,500 | = | 500 | + | 1,500 | + | 3,400 | + | 987 | + | 20,000 | + | 3,513 | 10,100 | – | 6,487 | = | 3,713 | 24,800 | Totals | |||

Closing Entries

Closing entries close out revenue, expenses, and dividends so the income statement can start count again and retained earnings will be accurate. In the horizontal model, we have seen this done many times by closing net income to retained earnings. In an accounting system, you click a button to make closing entries. When you do accounting long-hand on paper, you have to physically make the journal entry to close Revenue, Expenses, and Dividends to retained earnings. An easy way to remember this is RED and to do the journal entries in the RED order.

| Revenue Journal Entry | ||

| Revenue | 10,100 | |

| Retained Earnings | 10,100 |

| Expense Journal Entry | ||

| Retained Earnings | 6,487 | |

| Utilities Expense | 300 | |

| Wages Expense | 3,600 | |

| Income Tax Expense | 987 | |

| Cost of Goods Sold | 100 | |

| Salaries Expense | 1,500 |

| Dividend Journal Entry | ||

| Retained Earnings | 100 | |

| Dividends | 100 |

2.5b Example

Note: Download the 2.5a&b Example to view as you listen to me talk about Debits and Credits..

On June 30, 20X6, Wood, Corp. makes adjusting entries for the following transactions.

| Date | Transaction Detail |

|---|---|

| June 30a | At the end of the month, inventory was counted and had a value of $125,000. |

| June 30b | Adjust the prepaid insurance account for the amount used during the month. |

| June 30c | All employees are paid once a month and receive their paycheck on the tenth of each month. Payroll Expense for the month was $150,000. |

| June 30d | Income Tax Expense is calculated at 21%. |

Instructions:

- Using the t-accounts from 2.5a Example, prepare adjusting journal entries.

2.5b Practice

Geller Enterprises needs to prepare adjusting entries as of December 31, Year 4. Using the t-accounts from 2.5a Practice, prepare adjusting journal entries for the below transactions.

| Date | Transaction Detail |

|---|---|

| Dec. 31a | Recognized accrued salaries expense of $4,800. |

| Dec. 31b | The land purchased this year has a market value of $48,000. |

| Dec. 31c | Recognized interest revenue of $116. |

| Dec. 31d & e | There are two entries that occurred during the year that need to be adjusted. Make the adjustments. |

| Dec 31f | Do NOT calculate Income Tax expense for this problem. Income Tax expense is calculated differently based on circumstances and state. In this problem, we are assuming the company, for whatever reason, will not owe Income Tax expense. |

Check Figures:

- Cash, $122,400

- Net Income, $52,616

- Solution (Excel file will download)

2.5b Homework

On August 31, 20X4, Grazy Stokes Glass Blowers makes adjusting journal entries for the following transactions.

| Date | Transaction Detail |

|---|---|

| Aug 31a | Recognized administrative salaries of $4,200. |

| Aug 31b | Inventory was counted and has a value of $7,500. |

| Aug 31c | It was found that $2,000 was sold to a customer and not billed. |

| Aug 31d | Rent was paid for the entire year. We only want one month of rent in the month of August. Make the appropriate entry. |

| Aug 31e | Income Tax Expense is calculated at 21%. |

Instructions:

- Using the t-accounts in 2.5a Homework, prepare adjusting journal entries.

- Create financial statements.

- Prepare closing entries.

Licensing and Attribution:

Content on this page is adapted from the following openly licensed resource(s):

Principles of Accounting, Volume 1: Financial Accounting by Mitchell Franklin, Patty Graybeal, and Dixon Cooper licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License