Part 2: Fiduciary Duties to Shareholders, Partners, and Members

19 What are corporate constituency statutes?

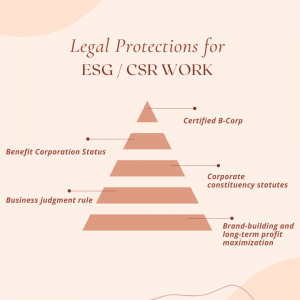

State law may provide an additional layer of protection for corporate boards who worry about being sued for their management of the corporation. So-called “corporate constituency” statutes specifically allow corporations to consider factors other than simply shareholder profit when making decisions. As with the business judgment rule, this will not protect them from abject violations of their fiduciary duty, but it will allow them to consider shareholder profit together with a broader set of concerns.

For example, consider Idaho’s corporate constituency statute:

Note the wide range of interests corporate boards in Idaho may consider in discharging their duties: the corporation itself (as opposed to just the shareholders), employees, customers, communities, and suppliers, and each of these in both the short and long-term.

These statutes are particularly relevant if someone offers to buy the corporation. Buying a corporation involves purchasing all of the stock of the corporation, so as to become the exclusive owner of the entity. The decision to sell or not resides with the board. If the board receives an offer above the current share price, it may be difficult to justify resisting a sale. Corporate constituency statutes provide flexibility in this decision. At the same time, a decision to resist a tender offer far above the share price may well violate the duty to shareholders. The shareholders might respond by voting in a new board at their next opportunity.

This represents a deep tension in the law that has no easy resolution. Yes, corporate boards may consider more than just shareholder profit when making decisions. Yet, if they ignore shareholder profit entirely they may find themselves sued for violating a duty or voted out of their positions.

An example of this is the decision of the Twitter Board of Directors to sell the company to Elon Musk during 2022. Musk, together with his financing, offered a priced well above Twitter’s share price at the time. Despite resistance by the Board due to differences in political opinions, and despite concern in some circles about the effect the purchase would have on speech, the Board approved the sale unanimously. The duty to shareholders, in this case, was found to be more persuasive than other concerns.

Exercises

- Read about the history of corporate constituency statutes on pages 209-212 of this article by Nathan Standley. How would you rewrite Idaho’s provision to satisfy the concerns raised in the article?