Part 6: Duties to the Environment

82 What is the Triple Bottom Line?

Recall our discussion of food labeling and regulatory nudges. While serving as a regulatory nudge rather than a command-and-control regulation about which foods may be bought and sold, food labels take advantage of a significant fact: they are comparable across foods. Because serving size is regulated by the FDA, one can pick up two packages of cookies and compare their calorie content, fat and protein content, and so on. Thus, consumers are able to reasonably quickly and efficiently optimize their purchasing decisions based on their diet. Financial reports, which you study in accounting classes, also share this aspect. By using standardized figures which disclose the financial health of a company, one is able to both assess how a company is doing and compare its performance to other companies. Then, when making an investment decision, that decision is informed by comparable, easily-located data.

Suppose that you wanted to invest in, or shop at, or work for, a company based on how they treated the environment. Ideally, one would be able to easily access comparable data about these companies’ environmental practices, compare them, and make a decision. Unfortunately, such an easily comparable system widely used by companies does not exist. Instead, a number of systems have been proposed, each with pros and cons. We will consider several of these systems.

People, Planet, Profit: The Triple Bottom Line

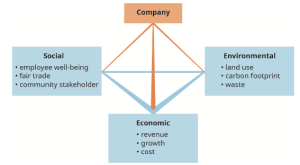

How can corporations and their stakeholders measure some of the effects of CSR programs? The triple bottom line (TBL) offers a way. TBL is a measure described in 1994 by John Elkington, a British business consultant, and it forces us to reconsider the very concept of the “bottom line.” Most businesses, and most consumers for that matter, think of the bottom line as a shorthand expression of their financial well-being. Are they making a profit, staying solvent, or falling into debt? That is the customary bottom line, but Elkington suggests that businesses need to consider not just one but rather three measures of their true bottom line: the economic and also the social and environmental results of their actions. The social and environmental impacts of doing business, called people and planet in the TBL, are the externalities of their operations that companies must take into account.

The TBL concept recognizes that external stakeholders consider it a corporation’s responsibility to go beyond making money. If increasing wealth damages the environment or makes people sick, society demands that the corporation revise its methods or leave the community. Society, businesses, and governments have realized that all stakeholders have to work for the common good. When they are successful at acting in a socially responsible way, corporations will and should claim credit. In acting according to the TBL model and promoting such acts, many corporations have reinvested their efforts and their profits in ways that can ultimately lead to the development of a sustainable economic system.

While some companies have long cared about TBL principles, social media has made it more easy to hold companies accountable. For instance, if a company states that it treats its employees a certain way, yet a viral post captures abuse of employees, the post may come to the attention of many more people than previously possible.

While the TBL represents an ideal, it has challenges in implementation. One significant challenge is that it provides no specific standards to report on employee well-being (happiness surveys? retention? occupational safety?), waste (what kind? how much?), and other non-financial factors. While “revenue” and “growth” may be well-defined in accounting standards, the TBL does not suggest how to define these non-financial measures.

Exercises

- For a corporation, how does considering a triple bottom line affect fiduciary duties towards shareholders?

- Read the article “25 Years Ago I Coined the Phrase ‘Triple Bottom Line.’ Here’s Why It’s Time to Rethink It.” What is the main critique in the article?

- This chapter includes content drawn from the OpenStax textbook Business Ethics, under a Creative Commons Attribution 4.0 International License (CC BY 4.0). Download for free at https://openstax.org/details/books/business-ethics. ↵