Part 2: Fiduciary Duties to Shareholders, Partners, and Members

18 What is the business judgment rule?

We have seen that corporate board members owe the corporation and its shareholders a fiduciary duty of loyalty and care. In essence, this makes them a very likely target for lawsuits! Business decisions are rarely perfect, hindsight is 20/20, and a corporation with thousands of shareholders will always have someone who believes that a bad business decision represented failure to take due care or exercise loyalty.

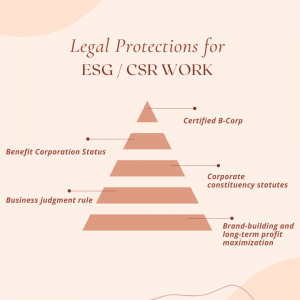

Because of this, corporate law contains a rule that gives corporate boards leeway in their decisions. Absent evidence of self-dealing, such as corporate board members using their position to benefit themselves, the business judgment rule presumes that the action was taken in the best interest of the corporation. Thus, if a corporate board exercises due diligence and decides to endorse a plan to open an office in New York rather than Los Angeles, or buy khaki pants for retail rather than navy, it will be very difficult for a shareholder to sue them even if those decisions turn out to be poor.

On the other hand, if a corporate board fails to do any homework, fails to supervise the actions of the corporation, or engages in self-dealing, the business judgment rule would not apply and the directors could be sued.

Exercises

- In the Caremark case considered in the prior question, should the business judgment rule have protected the board members?